Stock volatility calculator

Apart from this you also need the volatility value for any stock. Ad Whatever Your Investing Goals Are We Have the Tools to Get You Started.

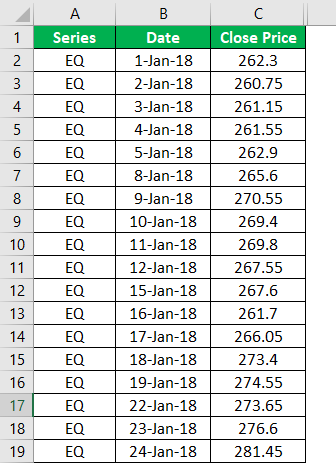

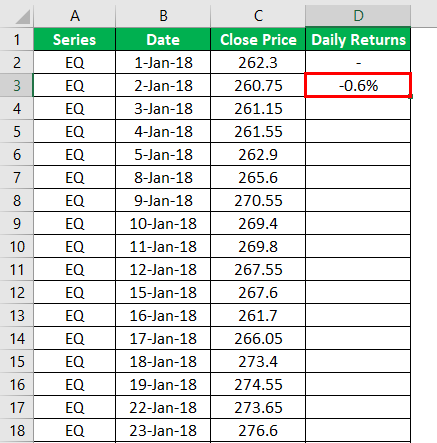

How To Calculate Volatility Of A Stock Or Index In Excel

Gather Market Insights From Professor Siegels Perspective On The Market Turbulence.

. Stock Volatility Calculator v1. The Probability Calculator can be useful for both stock and options traders alike. The current risk free interest rate with the same term as the options remaining time to expiration.

Black Scholes model assumes that. Your Long-Term Investment Goals Are Our Priority. How to use this volatility calculator.

Simply select a stock check all the populated fields choose a future date your forecasting volatility metric. Stock volatility where 25 25. Ad Get the Guidance You Need to Navigate the Daily Market Changes.

Taking the analysis of the historic data in terms of skewness and excess kurtosis as the starting point the volatility calculator estimates and graphs the volatility smile for each asset and. This is a free spreadsheet that downloads free historical stock data from the Yahoo database into the spreadsheet and calculates the historical or realized. Below are the calculated probabilites.

Standard Deviation r1rN Sqrt Variance r1rN where r1rN is. Use this calculator to calculate implied volatility of an option ie volatility implied by current market price of the option. Build a portfolio that could participate in markets ups and help mitigate downside risk.

Build Your Future With a Firm that has 85 Years of Investment Experience. It should be expressed as a continuous per anum rate. Ad Whatever Your Investing Goals Are We Have the Tools to Get You Started.

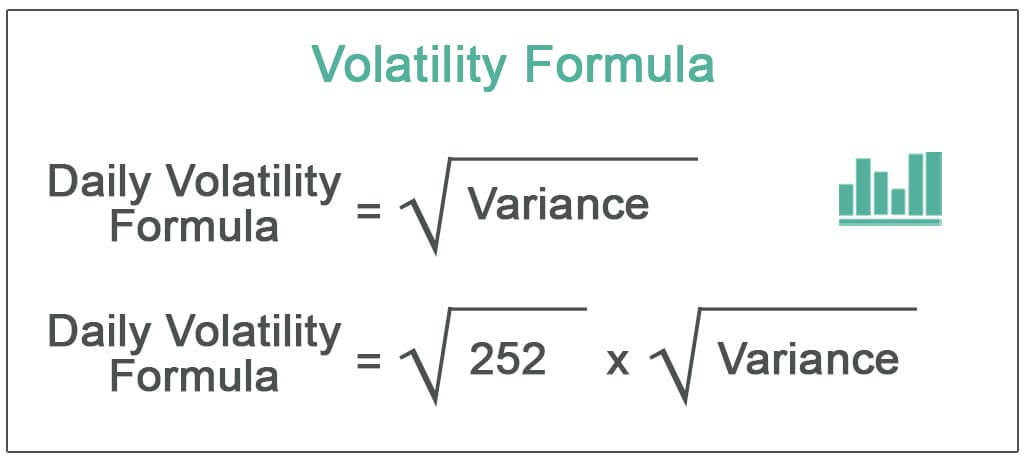

Screen compare over 30000 funds across the industry. Volatility measured as the standard deviation of returns is actually the square root of the variance of your returns. Ad Connect With Edward Jones And Learn More About The Current Market Fluctuations.

Build Your Future With a Firm that has 85 Years of Investment Experience. Probability of stock being above Target Price percent. To use this calculator you need the previous day closing price and current days prices.

If the price of a. Stock Volatility The relative rate at which the price of a security moves up and down. The Probability Calculator can be useful for both stock and options traders alike.

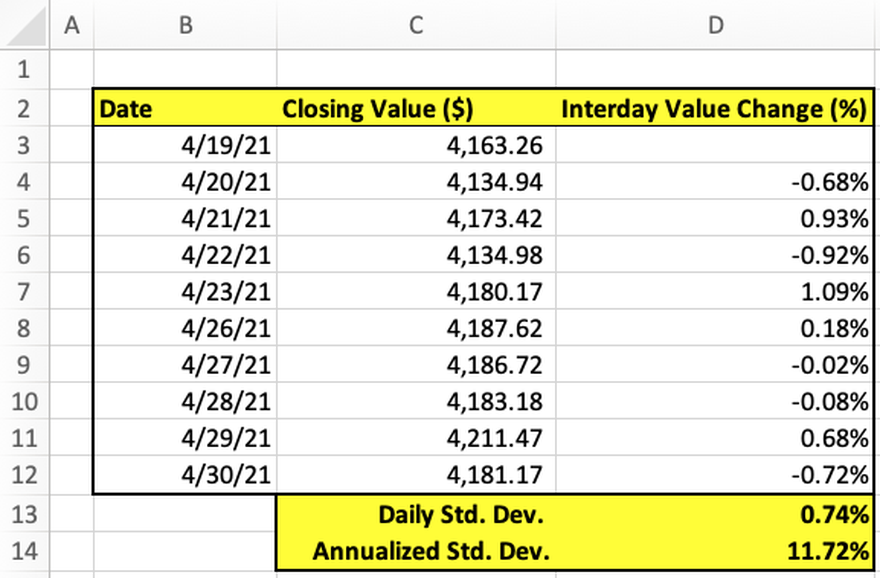

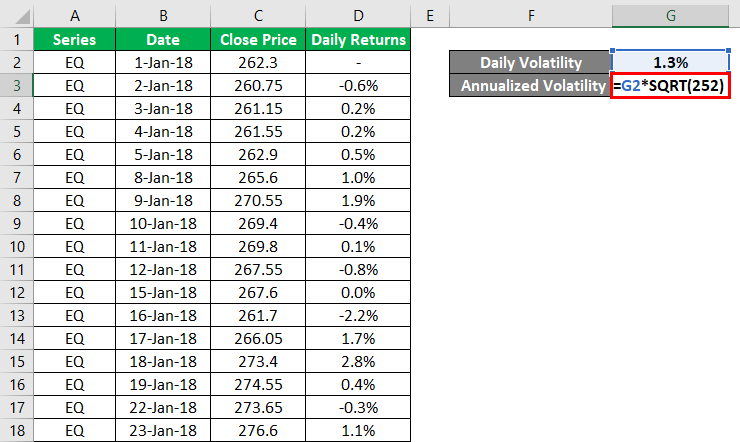

Simply select a stock check all the populated fields choose a future date your forecasting volatility metric. Volatility is found by calculating the annualized standard deviation of daily change in price. - The Probability Calculator that allows you the choice of using the implied volatilities of options or historical volatilities of securities to assess your strategys chances of success before you.

See our free volatility data section. Ad Discover a suite of low-volatility ETFs designed to weather market turmoil.

Volatility Formula How To Calculate Daily Annualized Volatility In Excel

Volatility Formula How To Calculate Daily Annualized Volatility In Excel

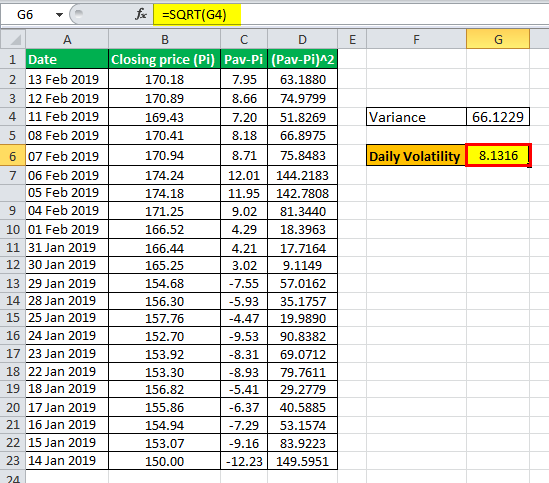

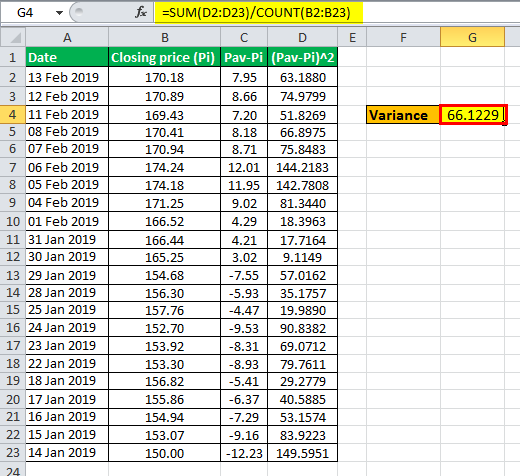

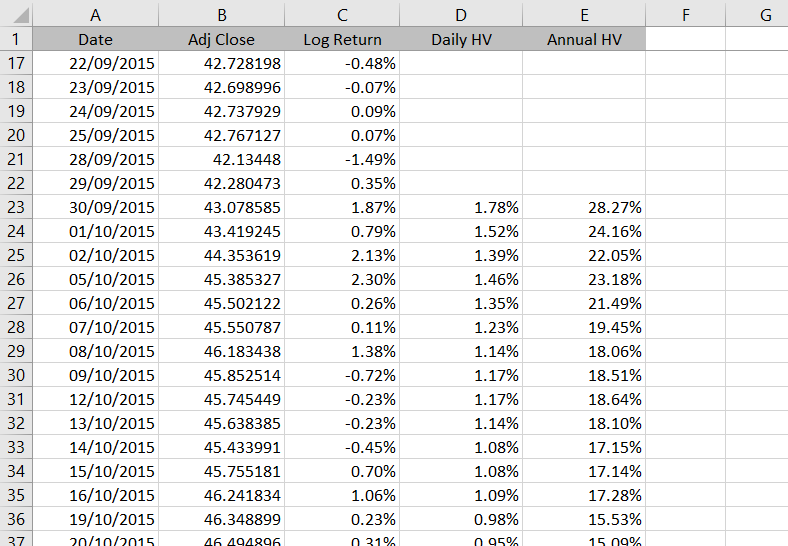

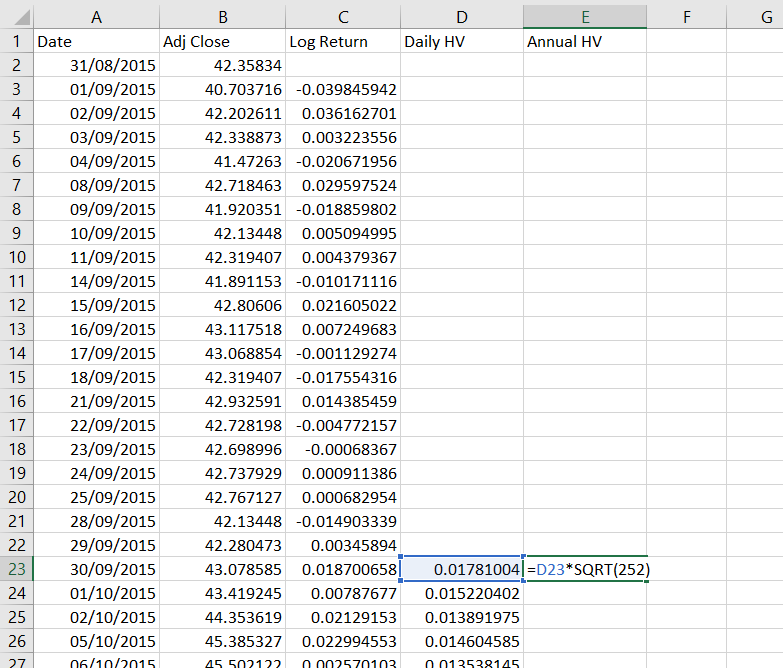

Volatility Calculation Historical Varsity By Zerodha

How To Calculate Volatility Using Excel

What Is Volatility And How To Calculate It Ally

What Is Volatility Definition Causes Significance In The Market

Volatility Calculation Historical Varsity By Zerodha

How To Calculate Volatility Using Excel

Volatility Formula Calculator Examples With Excel Template

Volatility Formula How To Calculate Daily Annualized Volatility In Excel

Volatility Formula Calculator Examples With Excel Template

How To Calculate Volatility Using Excel

How To Calculate Historical Volatility In Excel Macroption

How To Calculate Historical Volatility In Excel Macroption

Volatility Formula Calculator Examples With Excel Template

Price Volatility Definition Calculation Video Lesson Transcript Study Com

Volatility Formula Calculator Examples With Excel Template